The fast changing world is demanding a very crucial thing in everybody’s life i.e. golden years planning.

The nuclear families, children settling abroad, ever rising material quest for young generation etc. are the main reasons for not to forget retirement planning.

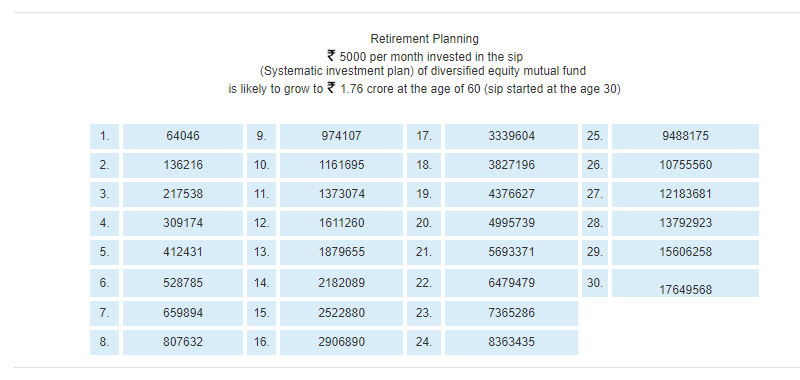

The last part of life – no working life – can be the best years in your life by investing as little as 5000/- p.m. or more. This can be done by investing in Systematic Investment Plan (SIP) of good Mutual Fund schemes.

*Calculated at an expected 12% rate of return per annum(monthly compounded) from equity Mutual Funds in India.

This is a hypothetical example showing power of compounding and power of long term equity investment through SIP.

Experts contend that retirement planning should start from the day you start earning. Sound advice indeed, but one that is seldom followed. Follow these simple rules and you can be sure to retire in comfort.

The first rule of retirement planning is also the easiest to follow. If you have a regular job, then your EPF account becomes a forced saving plan.

Given the power of compounding, even a small contribution will help a lot. The 10% rule is crucial for self-employed professionals and others who are not covered by the EPF umbrella. They can opt for mutual funds, choosing the ones that suit their risk appetite and age profile. However, you need to have the discipline to put away the given sum on a regular basis.

And don’t underestimate the significance of the savings in the first few years. Assuming that a 25-year-old investor puts away a fixed amount every month, his savings in the first five years will account for 44% of his total corpus when he is 60 years old. The later you start, the more you will need to save. If you have started late, say in your 40s or 50s, you will have to invest up to 20-25 % of your income if you want a comfortable retirement.

Start an SIP in a mutual fund and automate the process by giving an ECS mandate to your bank. In this way, your retirement planning will stay on track.

Even when there is a marked increase in the investible surplus, people don’t match their investments with the increase in income.

This is understandable since it is human nature to put things off, especially ones that require sacrifices in return for future rewards. This can severely undermine your retirement planning. If a 30-year-old with a monthly salary of 50,000 starts saving 10% (5,000) for his retirement every month in an option that earn 9% per year, he would have accumulated 92 lakh by the time he is 60. Now, assuming his salary increases by 10% every year and he raises his investment accordingly, he would have a decent retirement corpus of 2.76 crore.

It is important to maintain the retirement savings rate at 10% so that your nest egg doesn’t fall short of your requirements. The icing on the cake can be periodic boosters whenever you get a windfall, such as a tax refund or a lump-sum payment in the form of, say, an annual bonus. The trick is to commit yourself to save more in the future.

Whenever you get a raise, allocate half of it to savings. You might not notice the change since you will be enjoying the other half of the raise.

This might sound weird, but every time you change jobs, your retirement planning is at a grave risk. This is because you have the option to withdraw your PF balance at that time or transfer it to the account with the new employer. Besides, there is the option to withdraw your PF amount if you need the money for specific purposes, including your child’s marriage, buying or building a house, or in medical emergencies. Dipping into the corpus before you retire prevents your money to gain from the power of compounding. Don’t underestimate what this can do to your retirement savings over the long term. A person with a basic salary of 25,000 a month at the age of 25 can accumulate 1.65 crore in the PF over a period of 35 years. This is based on the assumption that his income will rise by 10% every year.

Yet, many people are unable to reach the 1 crore milestone in their PF accounts. Although the paperwork is minimal, a lot of people prefer to withdraw their PF money when they change jobs or for other purposes. This, despite the fact that the government discourages you from withdrawing the money. The withdrawals from the EPF within five years of joining are taxable.

The sudden flush of liquidity can trigger a spending spree and ill-planned decisions that can cripple your financial planning. Often, the money goes into discretionary spending, which means your retirement planning is back at square one. A late start means a smaller corpus even if you start investing more.

Instead of withdrawing your EPF balance when you change jobs, transfer it to the new employer’s account. This should be at the top in your list of priorities at the new workplace.

An investment portfolio’s performance is determined more by its asset allocation than by the returns from individual investments or market timing. How much you have when you attend your last day at work will depend on how you divided your retirement savings between stocks, fixed income and other asset classes.

Even within equities, the type of stocks (or equity funds) in your portfolio should vary with age.

This is not a hard and fast rule and should also take into account the financial situation of the individual. It assumes that all people at a certain age will have the same risk appetite. This is not true. A 45-year-old person with a good income and few dependants will be able to take on more risk than someone who is 30 but has a low and unsteady income.

Indian parents love to save for their children. Whether it is for their education or marriage, or even to provide them with a comfortable life, children are the biggest motivators of savings in the country. But before you pour money into a child plan, make sure your retirement savings target has been met. In an effort to fulfill the needs of the child, Indian parents sometimes sacrifice more than they should. Some even dip into their retirement funds to pay for the child’s education. This is risky because your retirement is going to be very different from that of the previous generations. It will be entirely funded by you and won’t have the cushion of defined benefits.

This doesn’t mean you should compromise on your child’s education. It can still be done through an education loan. In the past two decades, we have seen how the MRP of a product has been replaced by its EMI in our everyday lives. Home, travel, car, education, gold, consumer durables—you can get a loan for almost anything and everything. What’s more, the government encourages you to take loans by offering tax breaks on the interest paid on housing and education loans. No bank, however, is going to lend you for your retirement.

An education loan helps inculcate financial discipline in the child. If he is responsible for the repayment, he gets into the saving habit early in life.